Key Takeaways

- Accumulating wealth is a major driver of happiness for most Millennials

- They want to pass on a legacy to their heirs—which means values and morals as well as money

- Millennials have distinct charitable goals and intentions

Ultra-wealthy Americans—those with a net worth of at least $25 million—are increasingly seeing new faces among their ranks. But they’re often not the usual suspects—members of the Baby Boomer generation or older.

Instead, we’re seeing a surprising number of the ultra-wealthy among Millennials—those 72 million Americans born between 1981 and 1996.

Here’s a look at this large and increasingly important group, using research from CEG Insights’ 2023 report The $25 Million-Plus Opportunity. If you have family members who are Millennials, you can use these findings to size up how well you understand those loved ones. If you’re an affluent Millennial yourself, see how your goals, values and concerns compare to those of your peers.

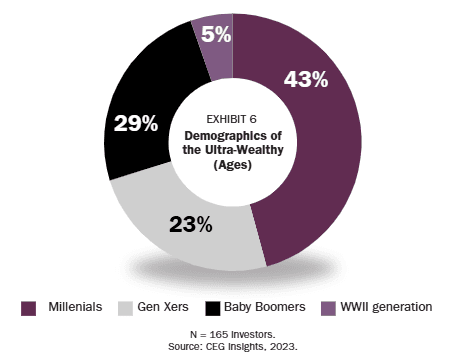

Millennials make up much of the ultra-wealthy market

It’s generally assumed that the wealthiest people are the oldest people—which, given how assets can potentially grow over time, makes sense. But when CEG Insights surveyed 165 of the ultra-wealthy, one surprising finding was that a sizable percentage—43.0%—were Millennials. That compares to 23% who were Gen Xers and 29% who were Baby Boomers (see Exhibit 6).

Millennials' values

When asked to define what their “best life” would look like, ultra-wealthy Millennials share some ideas with other generations, but differ in important ways too. For example:

- Millennials really value wealth. More than any other generational group, Millennials believe that happiness stems in large part from the amount of wealth they accumulate (89.5% versus 78.6% overall).

- Millennials don’t value spending over all else. An enormous percentage of ultra-wealthy Millennials (87.5%) say that saving and investing give them greater satisfaction than spending.

- Millennials have strong views on what “living their best life” means. The majority of Millennials say that living their best life means a life that aligns with their values. The other most common responses (cited by at least 40% of Millennials) were “maintaining good health,” “pursuing passions,” and “having fulfilling relationships with family and friends.”

Millennials were much more likely than Gen Xers and Boomers to say that a healthy work-life balance is important to living one's best life. And yet, they're also much more likely to list "professional achievements" as a key part of a great existence.

Millennials' financial concerns

Financially, Millennials’ concerns echo those of most other generational groups in several ways. For example, issues involving inflation, tax increases and stock market performance were all big concerns for Millennials as well as both younger and older investors.

That said, Millennials were significantly more likely than the ultra-affluent overall to cite two key concerns: interest rates (93.5% versus 84.0% overall) and maintaining their current financial position (90.4% versus 77.8%). Chances are, younger people are highly focused on the cost of credit card debt and mortgage payments—and, given the value they place on wealth accumulation, they’re acutely worried about not reversing course with their financial status.

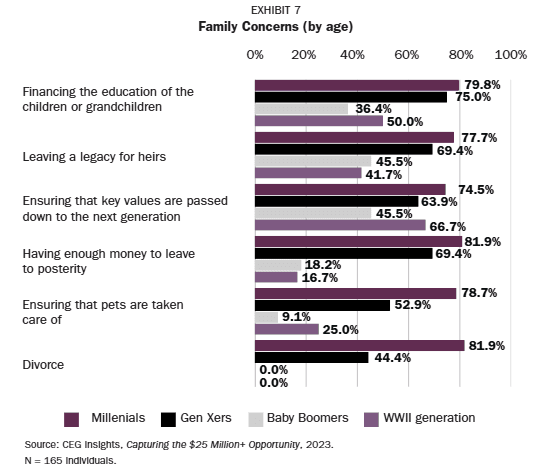

Millennials’ family concerns

It’s important to emphasize that Millennials don’t appear to be seeking to build significant wealth for only themselves and their own desires.

Consider that the vast majority of Millennials share a number of family-oriented financial concerns—such as having enough money to leave to posterity, paying for heirs’ education needs and leaving a legacy for their heirs (see Exhibit 7). Indeed, just 3.1% say they don’t want to leave a legacy.

Even their pets are top of mind in many cases, with nearly 80% of Millennials concerned about making sure their pets will be taken care of after they’re gone—far more than seen among any other group.

Millennials define what it means to leave a legacy to their heirs in a few key ways, including:

- Passing down significant financial assets (59.8%)

- Passing down their way of life (53.6%)

- Passing down morals and values (44.3%)

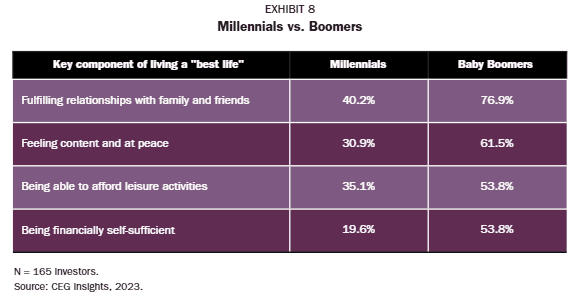

Key differences: Millennials versus Boomers

Many of Millennials’ key life values were noted above—such as maintaining good health and living a life that’s aligned with their values. However, there are some striking differences between Millennials and members of the Baby Boomer generation in terms of values.

When asked about specific components that make up someone’s “best life,” some sizable gaps were revealed, as shown in Exhibit 8.

Key differences: Millennials versus Gen Xers

A few key differences between Millennials and Gen Xers also stood out. For example, Gen Xers were even more likely to say that living your best life means “a life that aligns with your own values” (74.4% versus 58.8% of Millennials). But Gen Xers appear to care much less about professional success: Just 7.7% of Gen Xers say that’s part of the definition of living your best life—versus 22.7% of Millennials.

Recognizing these types of differences may be helpful when it comes to family members of different generations doing a better job of understanding each other’s feelings and priorities. Likewise, multigenerational work environments could be improved by having the various cohorts “get” each other on a deeper level.

Millennials’ view of financial help

The media has often painted Millennials as a generation that wants to be continually subsidized by their parents. And yet, the research reveals that Millennials’ ideas about financial support are largely mainstream. For example, when asked about areas where children should get financial help, Millennials’ answers largely tracked the responses given by the survey participants overall.

- 59.4% of Millennials say children should get financial help to pay for college, versus 68.2% of the ultra-wealthy overall.

- 40.6% of Millennials support getting help to buy a first home—versus 38.6% of the ultra-wealthy overall.

What’s more, Millennials were far more likely than other demographic groups to say that 18 is the age when children should be considered adults and should no longer rely on their parents—68.8% (versus 46.9% of the ultra-wealthy overall, and just 10% of the Baby Boomers).

Millennials and their financial advisors

Millennials’ concerns about family legacy, noted earlier, show up again in terms of their relationships with their financial advisors. For example, Millennials want their financial advisors to be involved in educating their children about money:

- A mere 2.1% of Millennials say they don’t care whether their advisor educates their children.

- In stark contrast, 23.1% of Baby Boomers don’t care.

Millennials’ preferred methods for advisor-based education of heirs include the following:

- One-on-one educational meetings (cited by 61.9% of Millennials)

- Online educational activities (43.3%)

- Webinars (38.1%)

- Creating a financial plan for the kids (36.1%)

Millennials and giving back

We also see that ultra-wealthy Millennials are often actively engaged in charitable giving, with $10,001 to $25,000 being the most common amount of money this group donates to charities in a typical year (21.6%). What’s more, a full 15.5% of ultra-wealthy Millennials give more than $250,000 in a typical year.

The bulk of those contributions are going to three main areas: religious organizations (18.4%), colleges/schools (15.2%) and environmental causes (12.4%).

Millennials’ preferred charitable-giving vehicle is the donor-advised fund: 81.4% have established and funded a DAF. That said, Millennials use multiple approaches to giving—such as writing checks to charities (64.9%) and giving through their wills (44.3%).

Conclusion

The picture that emerges of today’s ultra-wealthy Millennials is a complicated, complex one. Given that they make up a sizable percentage of the ultra-wealthy overall, it’s likely that they’ll play a significant role in areas such as saving, investing, spending and charitable giving in the years to come.

VFO Inner Circle Special Report

By John J. Bowen Jr.

© Copyright 2025 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, including but not limited to electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the author nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The author will make recommendations for solutions for you to explore that are not his own. Any recommendation is always based on the author’s research and experience.

The information contained herein is accurate to the best of the publisher’s and author’s knowledge; however, the publisher and author can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Nathan Brinkman is a registered representative and offers securities and investment advisory services through MML Investors Services, LLC. Member SIPC (www.sipc.org) Supervisory office: 900 E 96th St. Ste 300, Indianapolis, IN 46240 (317) 469-9999. Triumph Wealth Management, LLC is not a subsidiary or affiliate of MML Investors Services, LLC or its affiliated companies. Nathan Brinkman: CA Insurance License #0C27168 CRN202809-9701607