Key Takeaways

- Taxes—and the potential for rising tax rates—are on the minds of many wealthy investors.

- Investors are also worried about how to best pass along their values and beliefs to the next generation.

- Health concerns are top of mind for many investors—their own health, and the health of their spouses and parents.

Wealth can help people both avoid and address many challenges. But affluence doesn’t magically make all of life’s problems and worries disappear. Indeed, the wealthiest investors—the ultra-affluent, with a net worth of $25 million or more (not including personal residence)—studied by CEG Insights have a wide-ranging list of issues that concern them.

What’s more, a number of their concerns—about the state of the country, personal health, money and other key topics—may be on your own list of issues that weigh on you. To see how your concerns compare with those of the ultra-affluent—and for ideas on how to tackle those concerns effectively—read on for responses from 350 ultra-wealthy investors, summarized in the 2024 CEG Insights report, The $25 Million+ Investor.

Financial concerns

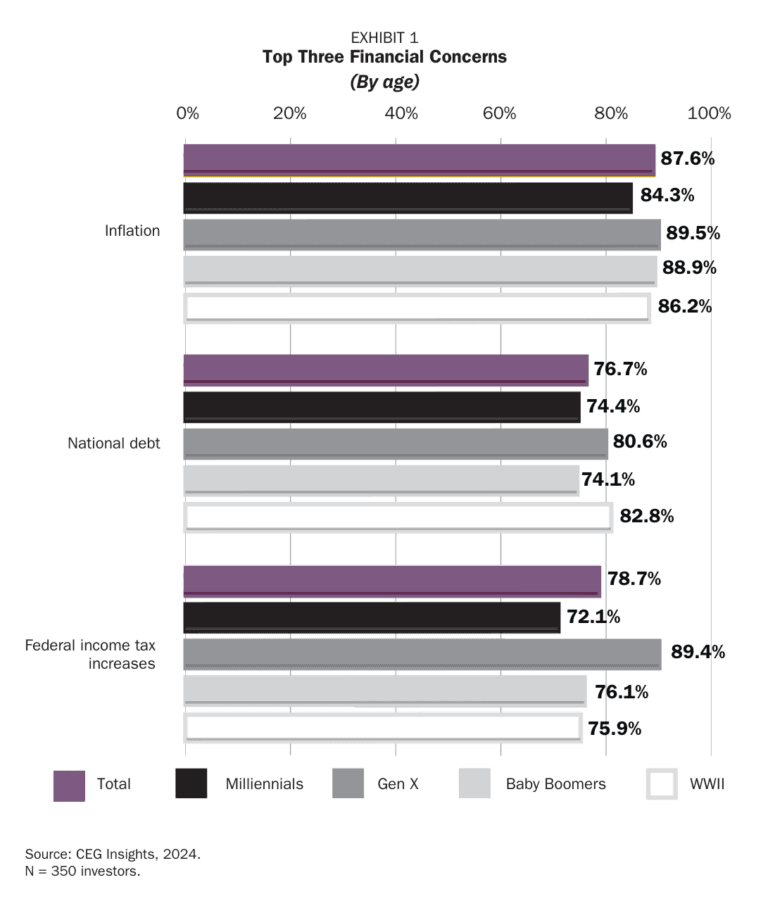

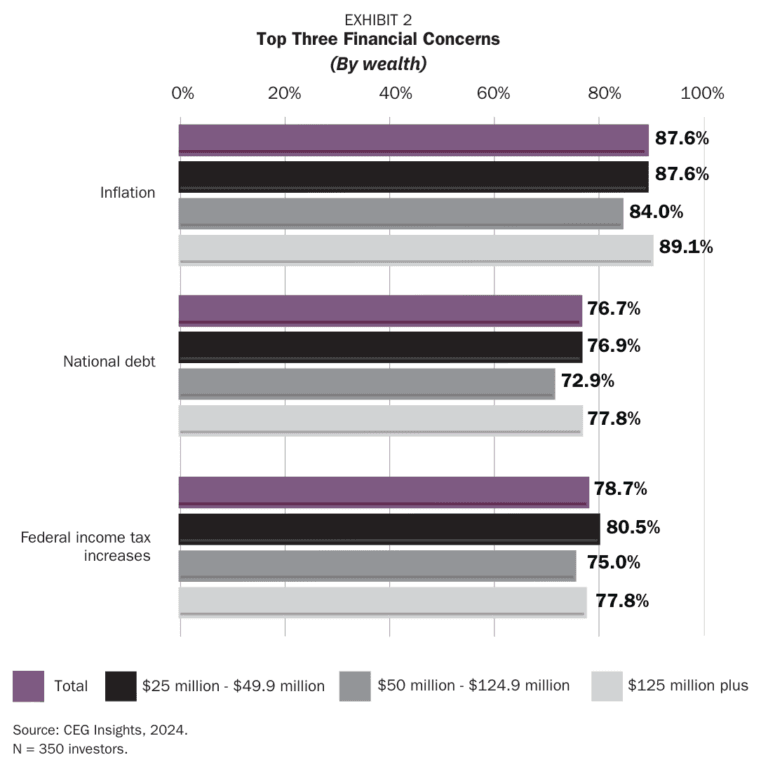

When focusing specifically on financial concerns, ultra-wealthy investors are apprehensive about inflation, the national debt, federal and state income tax hikes, stock market performance, and the possibility of a market correction. Wealthy millennials are particularly troubled by the prospect of rising state and federal taxes (see Exhibit 1). The very wealthiest investors—those with over $125 million of net worth—are the most concerned about market volatility, inflation and a potential market correction (see Exhibit 2).

Action step:

Continually assess your portfolios, incorporating your concerns into your wealth management strategies throughout the process. Bring comprehensive tax planning services into your overall wealth plan, and create diversified investment portfolios to minimize risk exposure. Regular discussions with trusted advisors about these strategies and concerns may help ensure that your wealth management plan remains aligned with both your needs and market conditions.

National concerns

Ultra-wealthy investors are primarily concerned about inflation, the national debt, federal and state income tax increases, stock market performance, and potential market corrections. The political environment is the most significant social concern for wealthy investors. Older investors are more worried than their younger counterparts about political issues. Immigration policies, crime rates, the national debt and climate change are also major concerns for over two-thirds of the wealthy. Among investors, Gen Xers are the most apprehensive about these social issues.

Action step:

Consider strategies to hedge against inflation and mitigate inflation risk in your portfolio. Also assess strategies aimed at navigating the uncertainties of the political landscape (particularly during election years).

Global and cybersecurity concerns

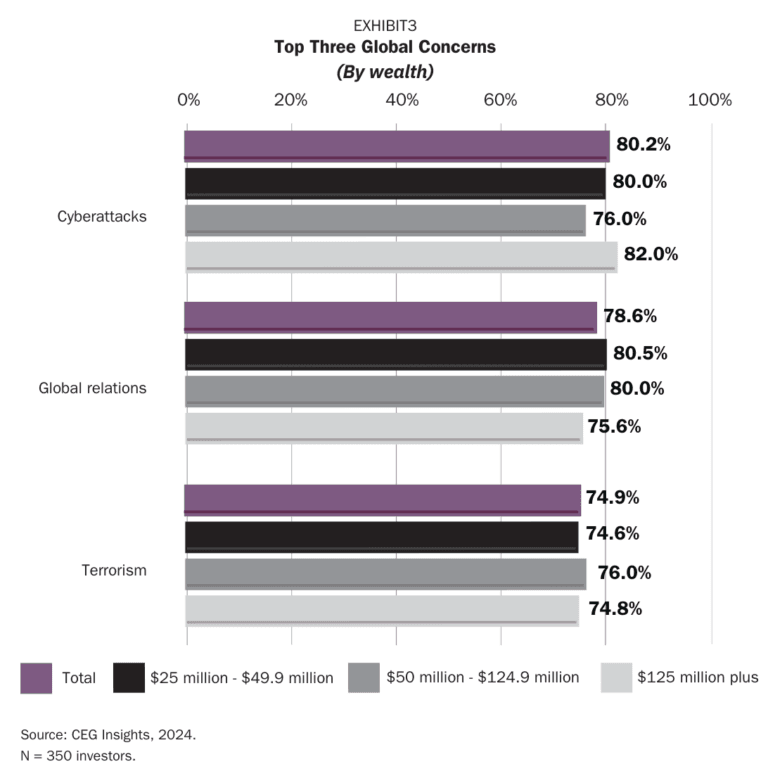

Cyberattacks, global relations and terrorism are major concerns for the ultra-wealthy, on the radar of approximately three-quarters of this demographic. Note that the most affluent investors are the most concerned about cyberattacks (see Exhibit 3).

Action step:

Protect your financial information with the latest cybersecurity protocols— and ensure that your financial services providers are doing the same. Beyond implementing cutting-edge security measures, get educated on the importance of cybersecurity and the steps you and your advisors need to be taking to safeguard your assets.

In addition to addressing cybersecurity concerns, stay vigilant about ongoing global issues—including terrorism and geopolitical risks. You don’t have to make changes to your plan based on every development, but it can be helpful to understand what is going on in the world and how those events are impacting the financial markets.

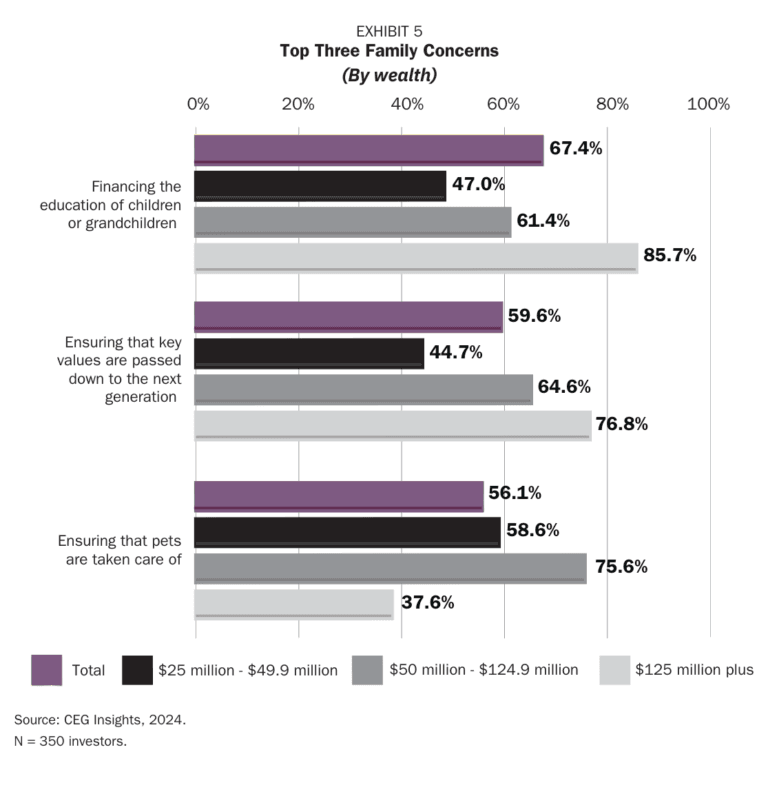

Family and legacy concerns

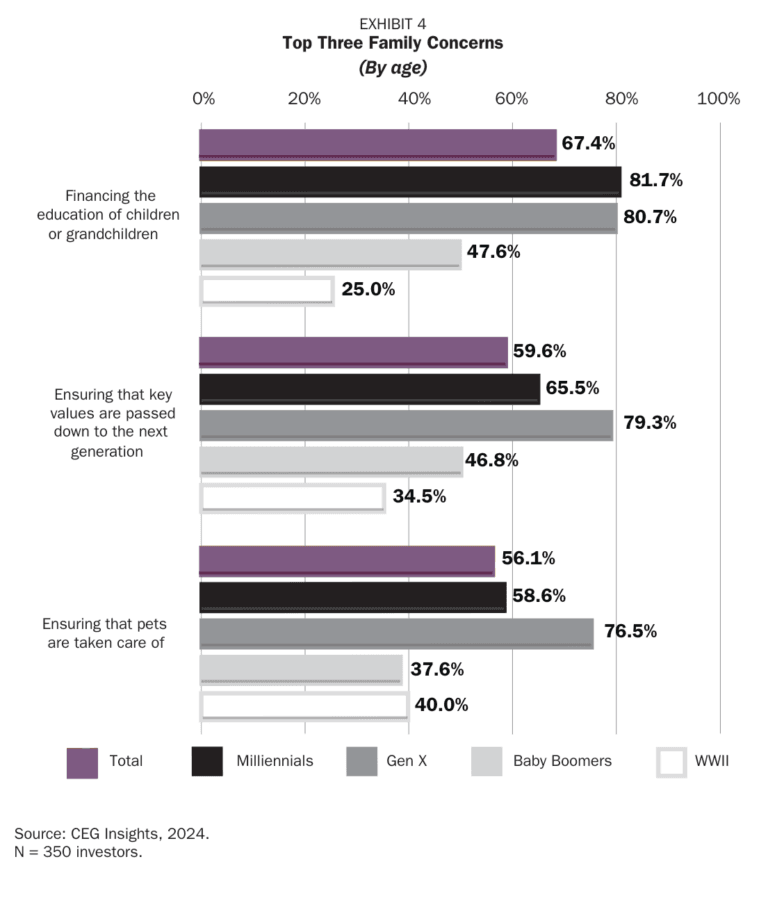

Closer to home, wealthy households—especially millennial and Gen X households— are concerned about financing their children’s or grandchildren’s education. This isn’t surprising, given that many investors pursue advanced or graduate degrees, which can be costly. And households with higher levels of wealth aren’t eligible for financial aid, meaning they often pay full tuition costs—often upward of $60,000 a year.

Additionally, younger households with assets exceeding $25 million place high importance on passing down values to the next generation, leaving a legacy for their heirs and ensuring their pets are well cared for. Protecting assets in the event of a divorce is also critically important for these younger generations. It’s worth noting that even the wealthiest investors are critically concerned about many of these issues.

Action step:

Tailor your financial plan to support your children’s and grandchildren’s educations (if this is a goal). Determine the most effective strategies to meet this objective, such as using tax-advantaged education savings plans like 529 plans.

Legacy planning is another critical component for wealthy families. Create a comprehensive estate plan that reflects your values and goals for the next generation, including—but not limited to—addressing your desire to leave a legacy, philanthropic efforts and even pet care.

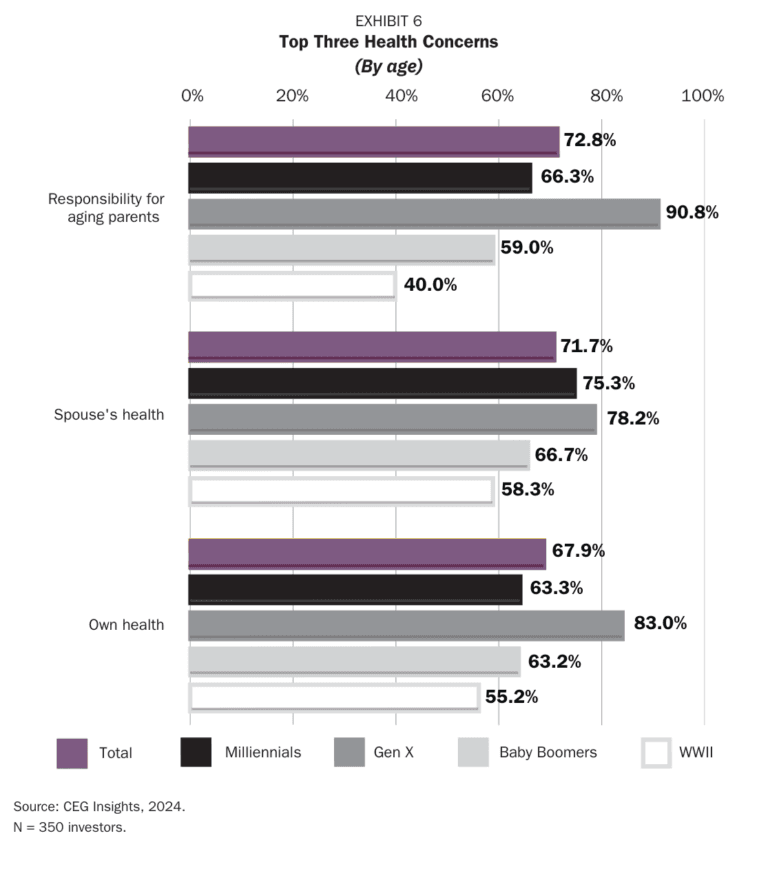

Health concerns

Health issues—particularly their own and their spouse’s health—are important to more than two-thirds of the wealthiest clients. Another significant concern is the responsibility of caring for aging parents. Gen X investors are apprehensive about these issues, particularly the care of elderly parents. Additionally, millennial and WWII generation investors are concerned about spending their final years in a care facility (see Exhibit 6).

Action step:

To address these concerns effectively, carefully examine the potential costs for long-term care, in-home services and specialized medical treatments. This knowledge can help you (and your advisors) develop more comprehensive financial planning that accounts for health care expenses and helps you prepare for potential caregiving responsibilities. Perhaps most important, be willing to openly discuss these issues. People often avoid these topics despite them being some of their greatest worries.

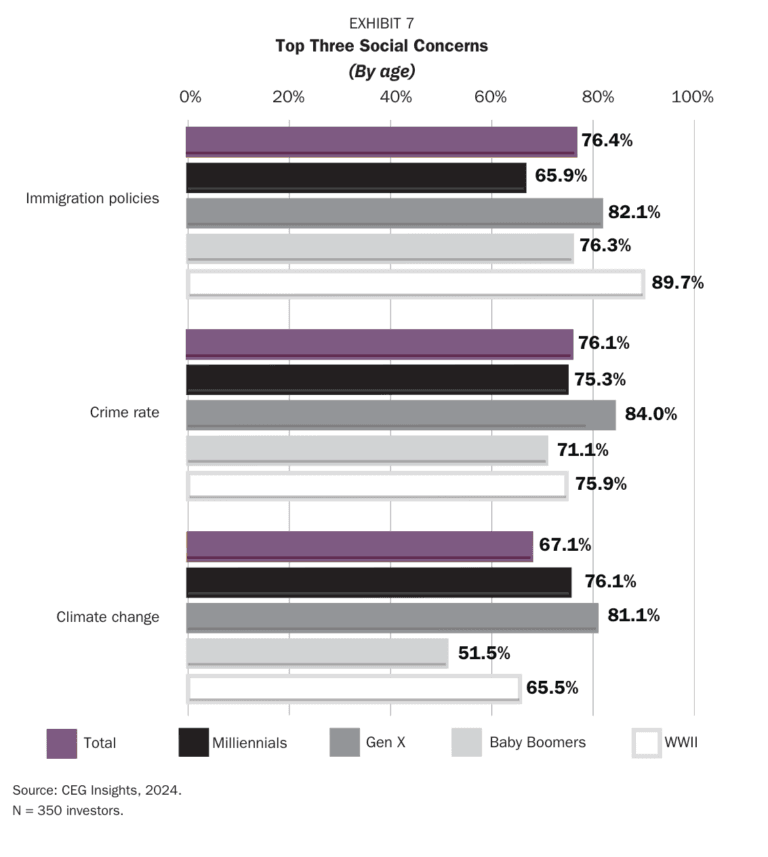

Social concerns

CEG Insights’ research found that WWII generation investors are more concerned than any other age group about immigration policies, with nearly 90% indicating it is a concern. They are less concerned than millennial and Gen X investors about the impacts of climate change, with 65.5% indicating it is a concern, compared with 81.1% of Gen Xers and 76.1% of millennials. Gen X investors are most concerned about crime rates (see Exhibit 7).

Action step:

Consider how these developments may or may not impact your wealth going forward. Although societal challenges are ever present, financial markets historically have had a habit of climbing that “wall of worry” to new heights over the long term (although, of course past performance is no guarantee of future results). That said, strategies that are built around big-picture changes—such as ESG investing, as one example—may be worth considering based on your goals and other factors.

Conclusion

There’s a good chance you share some of these same concerns yourself, even if you have far less than $25 million in net worth. And if you’re not a member of the ultra-wealthy demographic, it’s likely that some of these issues aren’t high priorities for you.

Regardless, one of the most important things you can do is recognize the key aspects of your life—financial, health, social and otherwise—that you’re concerned about. Benchmarking yourself relative to the ultra-wealthy is one way to do exactly that. By knowing what’s on your mind, you can take steps aimed at addressing those areas and creating a more secure financial future.

VFO Inner Circle Special Report

By John J. Bowen Jr.

© Copyright 2026 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, including but not limited to electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the author nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The author will make recommendations for solutions for you to explore that are not his own. Any recommendation is always based on the author’s research and experience.

The information contained herein is accurate to the best of the publisher’s and the author’s knowledge; however, the publisher and the author can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof. Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC. The information contained herein is accurate to the best of the publisher’s and the author’s knowledge; however, the publisher and the author can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Nathan Brinkman is a registered representative and offers securities and investment advisory services through MML Investors Services, LLC. Member SIPC (www.sipc.org) Supervisory office: 8888 Keystone Crossing #1600, Indianapolis, IN 46240 (317) 469-9999. Triumph Wealth Management, LLC is not a subsidiary or affiliate of MML Investors Services, LLC or its affiliated companies. Nathan Brinkman: CA Insurance License #0C27168 CRN202902-10536038