Key Takeaways

- Fewer than 20% of investors overall have established a formal asset protection plan.

- It’s important to have an asset protection plan in place before a claim is made against you.

- Get help to better ensure a plan is structured to protect your assets.

You might agree with the idea that having wealth is better than not having it. But sizable assets can be accompanied by significant potential problems.

Case in point: In our experience, the wealthy sometimes feel that they are targeted by unjust lawsuits and litigation. Indeed, you may very well know someone in your life who has been sued. Maybe it was you!

That means you should at least consider taking steps to protect the assets you’ve worked so hard to build from being unjustly taken. Otherwise, you may jeopardize your financial security and that of your family (and your company, if you’re an entrepreneur).

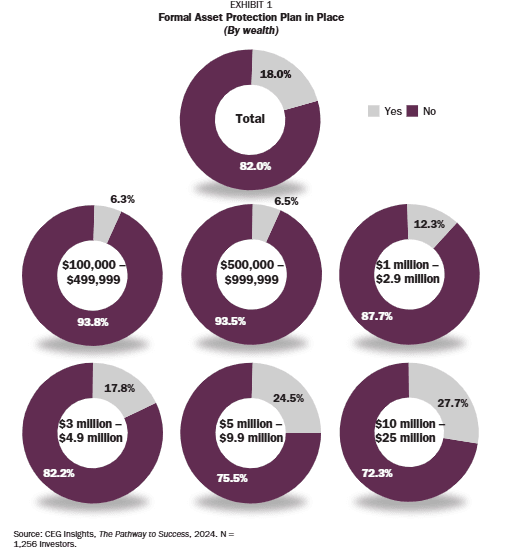

But the fact is, many wealthy individuals lack a plan to protect their assets. When CEG Insights surveyed 1,256 affluent investors with net worths ranging from $100,000 to $25 million, with 90% having over $1 million in net worth (not including their primary residence), here’s what they discovered:

- Fewer than 20% of investors overall have established a formal asset protection plan — and among those with net worths between $10 million and $25 million, just 27.7% have such a plan (see Exhibit 1).

- 40% of investors operate without umbrella insurance, exposing themselves to potential financial vulnerabilities.

- Gen X investors are the most lax in these areas—being the least likely to have both a comprehensive asset protection plan and adequate umbrella insurance.

- Less than 4% of investors whose net worth falls between $5 million and $25 million are covered by umbrella insurance of $5 million or more—indicating that even the most affluent investors may underestimate their potential risk.

Why you need to consider asset protection

The upshot: There’s at least a decent chance that asset protection could add value to your financial life.

The logic of asset protection planning is clear: You build a wall around your wealth that is as difficult as legally possible for litigators, creditors and others to scale. Instead of trying to fight it out with you in court for months or years and risk losing, the litigant sees that the only reasonable option from a legal standpoint is to settle for pennies on the dollar—or, ideally, to leave empty-handed.

Important:

Asset protection isn’t about “hiding money” from the world—quite the opposite, in fact. You want anyone who might come after your assets to clearly see what you have done to build a wall around your wealth. Why? It shows them the difficult legal path they’d have to take to get at that wealth—which, hopefully, will cause them to settle, negotiate, or (ideally) throw up their hands and walk away.

Five asset protection action steps

If you’re among the many successful people out there who lack an asset protection plan — or if you’re simply curious whether your existing plan is still as strong as it needs to be — consider taking a few key actions.

Step 1: Get protected before a claim against you is made.

You can do a lot to protect your wealth before a liability arises—but thanks to a concept known as “fraudulent conveyance,” very little can be done after. As with insurance, the time to have asset protection in place is well before you need it—or even think you might need it.

Step 2: Cover the basics.

Evaluate your liability insurance and other related policies, and maximize them as best you can. Probably the fastest, easiest and cheapest move you can make is to take out a large umbrella policy to safeguard assets. Another simple but powerful strategy can be to place your assets in someone else’s name, such as your spouse’s. If you’re sued, those spouse- controlled assets are often untouchable.

Pro tip: Be sure you have a great deal of trust in your spouse and your marriage before transferring ownership of assets to them. In a divorce, your spouse could potentially walk away with those assets—or you could be forced to fight for them at least as hard as you’d fight a creditor who went after them.

Step 3: Consider a variety of other asset protection strategies.

The asset protection strategies you may need will depend on your specific situation, of course. That said, it’s generally a good idea to consider your options, which might include:

- Ascertain appropriate utilization of risk transfer through property-casualty insurance (homeowner’s, auto, rental, personal excess liability [umbrella], health, disability, life, long-term care, directors’ liability and professional liability insurances).

- Use state law exemptions effectively (for example, the homestead exemption, the cash value of life insurance policies, retirement plans and annuities).

- Consider various forms of ownership that either put assets beyond the reach of a creditor or make the assets less desirable for creditors.

- Examine restructuring your current business.

- Discuss gifting assets when there are no current creditor issues in order to lessen the likelihood of raising fraudulent transfer issues.

- Look into advanced protection strategies that are commonly used by people with extreme wealth—such as equity stripping or closely held insurance companies. These strategies may be more than you need, but it’s good to know they exist and whether they might be a good fit. If there’s a lot of risk attached to what you are doing as a business owner—if your industry, company or competitors have gotten hit with lawsuits—then advanced asset protection strategies may be more applicable.

- Structure any expected gifts and/or inheritances to protect them from claims of creditors.

Step 4: Be sure your attorney or other professionals are qualified to help you protect your assets.

We see that some financial professionals aren’t in a position to provide guidance on and implementation of many asset protection solutions. Assess the asset protection expertise among your professionals—either the expertise they possess themselves or the resources they have access to via their professional networks of other experts.

One important move is to have a team in place to develop a coordinated response. It is very common to reach out to professionals for help with lawsuits, with the aim of avoiding litigation. Different types of professionals may get involved depending on the nature of the issues. If multiple professionals become involved in the process, there is likely to be a coordinator—sometimes known as the litigation problem-solver. At the same time, savvy lawyers are regularly a necessity, and they usually take a leading role in defusing litigious situations.

Step 5: Avoid big mistakes that will trip up your asset protection efforts.

Some asset protection strategies are complex and require a deep familiarity with and understanding of how they work in order to set up and execute them effectively. If poorly structured, asset protection strategies will have no “teeth” when they’re needed most—and business owners’ assets won’t be nearly as safe as they assume.

Example: Most advisors don’t appreciate the need to protect business owners on both the professional side and the personal side. Take real estate developers, for example, who commonly place each of their development projects in separate limited liability companies (LLCs). That way, if one project incurs a lawsuit, the others are protected. The problem: Those LLCs are many times set up so the developers own them directly. If they get hit with a personal lawsuit—they’re involved in a drunk driving accident or their child smashes a car into a school bus—all the assets in those LLCs could be up for grabs in the lawsuit.

Conclusion

You can’t necessarily stop someone from suing you. But you can take steps that will make it harder for litigants to collect money from you unjustly—and maybe even prevent those litigants from coming after you in the first place.

When you think about how hard you’ve worked to grow your assets, we think you’ll agree that it makes sense to put strategies in place to protect them too.

VFO Inner Circle Special Report

By John J. Bowen Jr.

© Copyright 2025 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, including but not limited to electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the author nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The author will make recommendations for solutions for you to explore that are not his own. Any recommendation is always based on the author’s research and experience.

The information contained herein is accurate to the best of the publisher’s and author’s knowledge; however, the publisher and author can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Nathan Brinkman is a registered representative and offers securities and investment advisory services through MML Investors Services, LLC. Member SIPC (www.sipc.org) Supervisory office: 8888 Keystone Crossing #1600, Indianapolis, IN 46240 (317) 469-9999. Triumph Wealth Management, LLC is not a subsidiary or affiliate of MML Investors Services, LLC or its affiliated companies. Nathan Brinkman: CA Insurance License #0C27168 CRN202902-10521972