Key Takeaways

- Private placement life insurance (PPLI) can be used (by some) to pursue tax planning and estate planning goals.

- PPLI has been deemed appropriate only for those who meet certain criteria.

- The potential benefits should be weighed in relation to the risks.

Affluent investors, in our experience, tend to share a few key concerns. Two of the biggest are reducing their tax burden and taking care of their heirs.

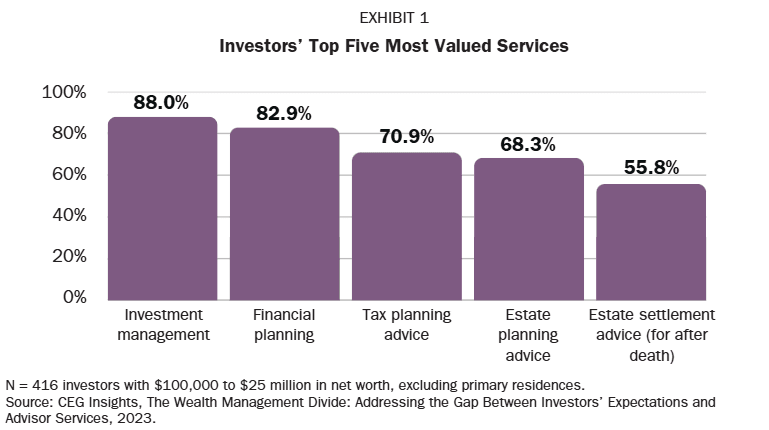

For example, when CEG Insights surveyed wealthy investors with $100,000 to $25 million in net worth (excluding their primary residences), tax planning advice was seen as one of the top five most valued advisor services by 70.9% of investors (see Exhibit 1). What’s more, 89.2% of investors said tax planning was a service they desired.

When it comes to leaving a legacy to one’s heirs, 92.5% of affluent investors in the same study told CEG Insights they desired wealth transfer advice from advisors, while 91.1% wanted estate planning advice. Likewise, 90.4% wanted help with trusts.

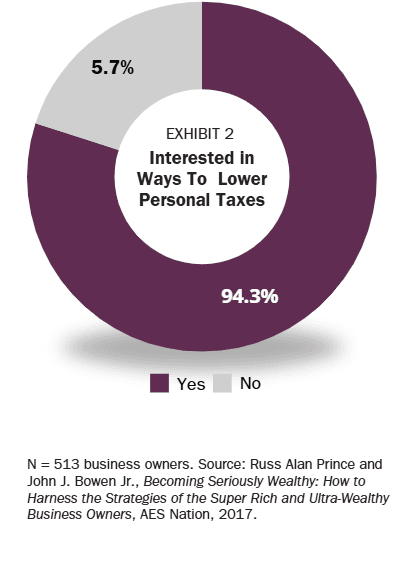

Tax mitigation is also on the minds of affluent business owners. Among 513 successful business owners surveyed for a different study (by AES Nation), 94.3% said they were interested in ways they can legitimately lower their personal taxes (see Exhibit 2).

There are numerous ways to pursue those goals, of course. But one method that often gets overlooked is an insurance- based strategy known as private placement life insurance (PPLI). It’s certainly not for everyone—but it does offer the potential to achieve some major goals, along with some important risks to consider.

How PPLI works

Essentially, PPLI is a variable universal life (VUL) insurance vehicle—which means it features characteristics that are most commonly associated with VUL, such as:

- The potential for tax-deferred growth. Investments in the life insurance policy grow and compound tax-deferred (dividends, interest and capital gains). If you maintain the policy for life—and the investments perform well—you can potentially build up significant cash value without paying tax along the way.

- Access to the accumulated cash value. Withdrawals or loans from the policy’s cash value can be made free of income tax if done properly.

- Tax-free transfer of wealth. The policy proceeds can go to beneficiaries after the insured’s death, income tax-free—thereby eliminating the deferred gains. With proper planning, the proceeds also could be inheritance tax-free.

One major difference, however, is that the investment choices available through PPLI policies tend to be broader than those offered through standard VUL policies. For example, some PPLI policies may be able to invest in so-called alternative investments such as hedge funds, real estate, private equity and private credit.

Not surprisingly, that flexibility gets the attention of many high-net-worth investors— particularly those living in states with high combined federal and state income tax rates— with relatively illiquid or sophisticated holdings. Hedge funds, for example, often generate a significant amount of taxes, which investors can potentially defer if their hedge funds are part of a PPLI policy.

Another important PPLI characteristic that many high-net-worth investors value is creditor protection. PPLI has the potential to provide strong asset protection. In some states, the policy’s cash value and death benefit may be shielded from creditors. Note, however, that these protections can vary from state to state.

As you might expect, PPLI also comes with certain risks—more on that below.

Who might want to consider PPLI?

Another key difference: Not just anybody can implement a PPLI-based strategy. PPLI has been deemed appropriate only for those who are considered to be accredited investors and qualified purchasers.

- Accredited investor: The Securities and Exchange Commission sets specific guidelines and criteria for individuals and entities to qualify as accredited investors. For example, an individual person can qualify as one if they have an annual income exceeding $200,000 ($300,000 for married couples) or a net worth of over $1 million, not including their primary residence.

- Qualified purchaser: An individual or entity must meet even more stringent financial thresholds to be considered a qualified purchaser, such as holding at least $5 million in investments. This classification allows access to certain investment opportunities that are not available to accredited investors.

In general, one example of a potentially good candidate for PPLI is someone who meets one of the following criteria:

- Has a high net worth and can fund significant amounts in annual premiums for the first several years. (The idea here is to attempt to fund as large an amount as possible into the policy as fast as possible, to maximize the tax-deferred growth potential the policy provides.)

- Has (or wants to invest in) highly tax-inefficient alternative investments, such as hedge funds.

There’s even the possibility that the policy becomes self-funding, meaning the growth in its cash value can cover the cost of the premiums. Business owners experiencing a large liquidity event might also want to consider PPLI.

Those investors with a strong charitable intent might also give PPLI a look. That’s because if you have a significant windfall that results in a large infusion of ordinary income in a particular year, PPLI (in conjunction with a charitable trust) can potentially offset the tax while supporting charities (such as private foundations). And with proper planning, the cash-value appreciation and insurance coverage may also avoid gift and estate taxes.

Risks and issues to consider

Clearly, PPLI isn’t appropriate for (or accessible to) everyone. Even for those who qualify and may be good candidates, there are several important risks and rules to consider when evaluating PPLI-based strategies. For example:

- You can’t control the investment decisions. A third-party manager has to invest and manage the cash value of the PPLI. The policy owner—you—must give up control over the investment decisions for the account. That means you can’t select investment assets, vote on the securities or exercise rights pertaining to these securities, or extract money from the account by a withdrawal. If you breach this “investor control doctrine,” you risk being required to include all interests, dividends and other income earned by the policy assets in your gross taxable income.

You have to pass a diversification test. The PPLI policy must follow regulations about the minimum number of investments held in the account and the maximum asset values of the investments. For example, no single investment can make up more than 55% of the insurance subaccount portfolio—and, generally, each portfolio must contain at least five investments.

policy to offset gains elsewhere in your portfolio and engage in tax-loss harvesting. The losses are not tax-deductible.

Don’t look to do tax-loss harvesting. You won’t be able to use any losses in a PPLI policy to offset gains elsewhere in your portfolio and engage in tax-loss harvesting. The losses are not tax-deductible.

There’s the potential for IRS scrutiny. As is often the case with tax-advantaged solutions aimed at the affluent, PPLI rules run the risk of being changed by the IRS or Congress, depending on the prevailing political winds.

They’re complex. The rules and regulations regarding PPLI can be challenging to understand and follow. Setting up a PPLI policy correctly—and incorporating it into a broader wealth management plan—requires the right type and level of expertise.

A good cost-benefit trade-off isn’t guaranteed. The idea with PPLI is that the growth and tax savings over time will outweigh the cost of the insurance (which includes the actual cost of the insurance coverage, deferred acquisition costs and various fees). But there’s the risk that the insurance-related expenses exceed the potential savings.

Conclusion

Ultimately, PPLI has the potential to be a key component of an overall wealth management plan, depending on your financial situation and your goals. It’s worth a look if you qualify for it today—and it’s a good idea to at least have PPLI on your radar screen if you think you might be in a position to make use of it down the road. Just don’t overlook the risks and complexities that accompany this option.

VFO Inner Circle Special Report

By John J. Bowen Jr.

© Copyright 2025 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, including but not limited to electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the author nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The author will make recommendations for solutions for you to explore that are not his own. Any recommendation is always based on the author’s research and experience.

The information contained herein is accurate to the best of the publisher’s and author’s knowledge; however, the publisher and author can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Nathan Brinkman is a registered representative and offers securities and investment advisory services through MML Investors Services, LLC. Member SIPC (www.sipc.org) Supervisory office: 8888 Keystone Crossing #1600, Indianapolis, IN 46240 (317) 469-9999. Triumph Wealth Management, LLC is not a subsidiary or affiliate of MML Investors Services, LLC or its affiliated companies. Nathan Brinkman: CA Insurance License #0C27168 CRN202809-9504445