Key Takeaways

- Focus on six areas of wealth management—including legacy planning and health and lifestyle management.

- Assess the impact of global economic trends and other external factors and how they might influence wealth management decisions.

- Pay attention to how wealth management-related technology is evolving.

In the ever-evolving wealth management landscape, high-net-worth individuals and families require a sophisticated, multifaceted approach to preserve and grow their assets while addressing their unique needs and aspirations.

The ultra-wealthy—those with at least $25 million in net worth (not including their primary residence)—recognize this. As a result, they often manage their financial lives using an advanced framework that provides a holistic view of wealth management, ensuring that all aspects of a client’s financial life are effectively addressed.

Adopting this framework—even if you have a net worth that’s far less than $25 million—can potentially enable you to manage your own financial life more effectively.

Who are the ultra-wealthy, anyway?

Based on research conducted annually by CEG Insights, those with more than $25 million of net worth (not including their primary residence) represent approximately 269,000 households in the U.S. More than half (58.3%) of these investors reported that they inherited their wealth, with this percentage increasing significantly among ultra-wealthy millennial and Gen X investors. While hard work remains the most common factor in wealth creation, education and astute investing also play crucial roles.

Additionally, younger investors are more inclined to recognize family connections as essential to their wealth accumulation. Similarly, 82.8% of the wealthiest households indicate that inheritance was critical to their wealth creation. The richest investors are also more likely than others to acknowledge selling a business as part of their wealth creation.

A comprehensive model

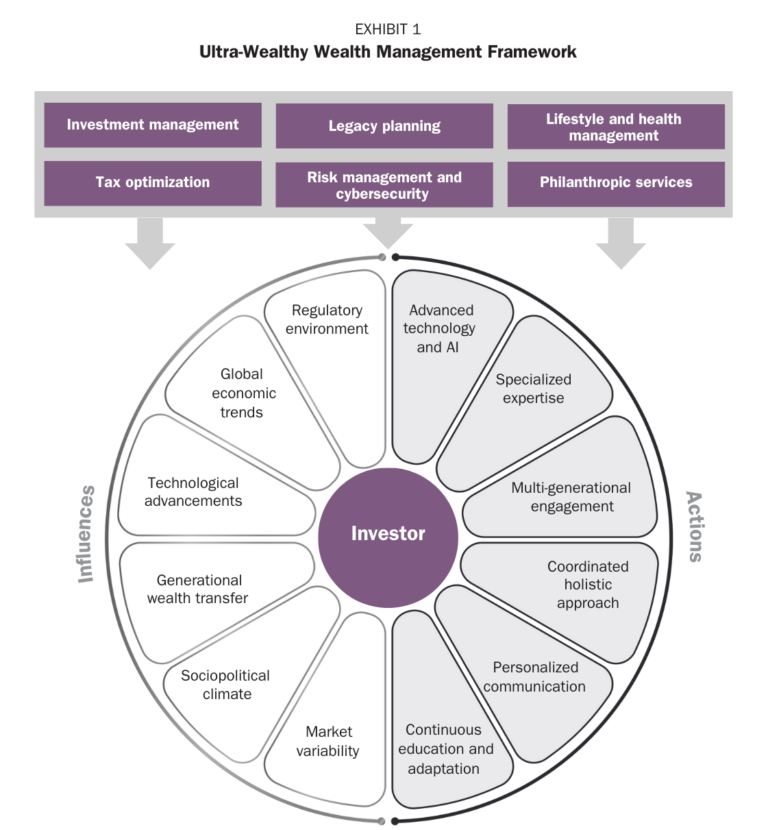

The ultra-wealthy framework for managing wealth integrates six critical service areas with external influencing factors and internal enabling strategies and actions (see Exhibit 1).

The affluent must navigate a complex financial services and strategies landscape. The top of the model—the items in gold—identifies six key areas of concern, each demanding careful attention:

- Investment management. The cornerstone of wealth preservation and growth, investment management encompasses not just basic portfolio construction but also sophisticated strategies involving global diversification and alternative investments. Investors need to adapt their approach to ever-changing market conditions while balancing risk and return.

- Tax optimization. In today’s complex tax environment—especially for high-net-worth individuals with diverse income streams and international interests—strategic tax planning can significantly impact overall wealth. Tax strategies are crucial in minimizing tax liabilities, from leveraging tax-advantaged accounts to timing income recognition and implementing charitable giving strategies.

- Legacy planning. This area extends beyond the basic estate planning that many people do to include intricate trust structures, succession planning for family businesses and strategies for intergenerational wealth education. As digital assets become increasingly prevalent, affluent investors should also be aware of new issues to consider in inheritance planning.

- Risk management and cybersecurity. This dual focus acknowledges both traditional risks—requiring comprehensive insurance coverage and continuity planning—and the growing threat of cyberattacks and identity theft. These days, it seems, those with significant wealth need to be as vigilant about digital security as they are about financial market risks.

- Lifestyle and health management. Wealth management goes beyond purely financial matters, of course. Depending on needs and goals, a holistic approach might also encompass concierge medical services, wellness programs and even personal security services. By addressing these aspects of their lives, the affluent can better ensure that wealth translates to well-being.

- Philanthropic services. Many high-net-worth individuals want to create lasting, positive impacts. This goes beyond simple charitable giving to include impact investing, venture philanthropy and the establishment of private foundations. Aligning values with effective giving strategies and measuring philanthropic outcomes are important issues in this space.

How well does this list reflect your own needs, goals and priorities? Keep in mind that while these areas are presented in a prioritized list, the reality is that they are deeply interconnected. A decision in one area often has ripple effects across others. For instance, an investment strategy should consider tax implications, while philanthropic goals might influence legacy planning.

Next, note that investors are at the model’s center, surrounded by factors that influence wealth management, which are split into external forces (like market variability) and internal strategies. Some of the key external factors that can impact your portfolios and strategies include:

- Global economic trends. These encompass macroeconomic indicators such as gross domestic product growth rates, inflation, interest rates and trade balances across different countries and regions. They also include shifts in economic power, emerging market dynamics and global financial crises. Staying attuned to these trends can potentially help anticipate market movements and adjust investment strategies accordingly.

- Technological advancements. This factor refers to the rapid pace of innovation in fields like AI, blockchain, fintech and digital currencies. These advancements can disrupt traditional financial services, create new investment opportunities, and change how wealth is managed and transferred. Investors should understand these technologies in order to leverage their benefits and mitigate potential risks.

- Regulatory environment. This includes changes in financial regulations, tax laws, reporting requirements and compliance standards across different jurisdictions. The regulatory landscape constantly evolves, often in response to financial crises, technological innovations or changing political priorities.

- Geopolitical climate. This factor covers political events, international relations, trade agreements, sanctions and conflicts that can significantly impact global markets. Geopolitical tensions can lead to market variability, currency fluctuations and changes in investment flows. By monitoring these developments, investors can potentially assess the potential impact on their portfolios.

The right side of the model provides a list of internal drivers and actions for handling these concerns. These represent strategies that may help investors make better decisions—or empower advisors with whom the investors work to provide personalized, effective advice. These strategies include:

- Advanced technology and AI. This involves the integration of cutting-edge technologies like AI, machine learning and big data analytics into wealth management practices. These tools can enhance portfolio management, risk assessment, client profiling and predictive analytics. They can also improve operational efficiency and provide more accurate, data-driven insights.

- Continuous education and adaptation. This strategy emphasizes the importance of ongoing learning and flexibility in the face of changing market conditions and client needs. It involves staying updated on the latest financial theories, investment products and market trends. It also includes the ability to adapt strategies quickly in response to new information or changing circumstances.

- Specialized expertise. This refers to the development of deep knowledge in specific areas of wealth management, such as sustainable investing, private equity or cross-border wealth management. Having specialized expertise allows advisors to provide more nuanced, sophisticated advice tailored to specific client needs or market segments.

- Multigenerational engagement. This strategy involves working with entire families across different generations. It includes understanding the unique needs and perspectives of each generation, facilitating effective wealth transfer and educating younger family members about wealth management. This approach helps promote successful intergenerational wealth preservation.

- Personalized communication. This factor emphasizes the importance of tailoring communication styles and methods to each person’s preferences and needs. It involves using a mix of traditional and digital communication channels, providing customized reports and updates, and ensuring that complex financial information is presented in a way that is easily understood.

Conclusion

By prioritizing six areas—from investment management to philanthropic services—and considering both external influences and internal strategies, investors can take a much fuller and more comprehensive view of their financial lives—and the advisors working with them can potentially deliver advice that is tailored to each individual.

Perhaps most important: You don’t need to have tens of millions of dollars to adopt this model for managing your financial life.

VFO Inner Circle Special Report

By John J. Bowen Jr.

© Copyright 2026 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, including but not limited to electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the author nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The author will make recommendations for solutions for you to explore that are not his own. Any recommendation is always based on the author’s research and experience.

The information contained herein is accurate to the best of the publisher’s and author’s knowledge; however, the publisher and author can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Nathan Brinkman is a registered representative and offers securities and investment advisory services through MML Investors Services, LLC. Member SIPC (www.sipc.org) Supervisory office: 8888 Keystone Crossing #1600, Indianapolis, IN 46240 (317) 469-9999. Triumph Wealth Management, LLC is not a subsidiary or affiliate of MML Investors Services, LLC or its affiliated companies. Nathan Brinkman: CA Insurance License #0C27168 CRN202901-10220045